A mutual fund is an investment vehicle that pools money from multiple investors and uses it to invest in a diversified portfolio of stocks, bonds, or other securities.

It is managed by a professional fund manager who makes investment decisions on behalf of the investors.

Each investor in a mutual fund owns shares, representing a portion of the fund’s holdings.

Why Buy a Mutual Fund?

There are several reasons why investors may choose to buy a mutual fund:

- Expert Management: Mutual funds are managed by professionals, saving investors time and effort in individual security selection

- Flexibility: Mutual funds provide diverse choices like equity, bond, and money market funds, aligning with risk tolerance and investment goals

- Tax-Efficient: Some funds minimize taxes through strategies like tax-loss harvesting and low portfolio turnover

- Diversification: Helps spread risk and reduce the impact of individual security’s performance on the overall portfolio

- Accessibility: Provide an easy and convenient way for individual investors to access a diversified investment portfolio, even with a small investment amount

- Affordability: Have a lower entry cost compared to other investment options, allowing investors to start with small amounts and gradually increase their investment over time

- Liquidity: Are highly liquid, allowing investors to buy or sell their shares on any business day, providing flexibility for short-term or long-term investment goals.

- Transparency: Mutual funds must disclose their holdings and performance regularly, providing clarity to investors about the fund’s investments and performance.

How Does a Mutual Fund Work?

Mutual funds work by pooling money from multiple investors and buying a diversified portfolio of securities. The investors own shares or units of the mutual fund, representing their ownership of its assets. The value of these shares or units fluctuates based on the performance of the underlying securities in the portfolio.

Here’s a step-by-step breakdown of how mutual funds work:

- Investors purchase shares or units of a mutual fund through a broker, financial advisor, or directly from the fund company.

- The fund manager uses the money pooled from the investors to buy a diversified portfolio of securities based on the fund’s investment objective.

- The fund manager makes day-to-day investment decisions, such as buying and selling securities, based on their research and analysis.

- The fund’s performance is tracked daily. The value of the shares or units is calculated based on the fund’s net asset value (NAV), which is the total value of the fund’s assets minus its liabilities, divided by the number of outstanding shares or units.

- Investors can buy or sell their shares or units of the mutual fund on any business day at the NAV price, calculated at the end of each trading day.

What are Mutual Funds Costs and Expenses?

Similar to any business, operating a mutual fund incurs costs. These costs include shareholder fees for transactions and ongoing operating expenses for managing the fund, marketing, distribution, and administrative tasks.

Also Read:

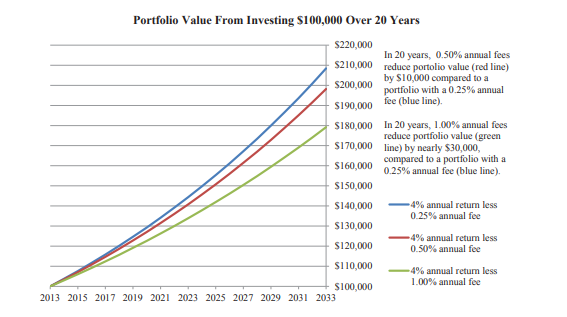

These fees vary from one fund to another, affecting an investment’s long-term performance. A mutual fund cost calculator will help you calculate costs for different funds.

The graph below shows the costs and expenses fees’ effects on your mutual fund investment portfolio.

(i) Shareholder fees

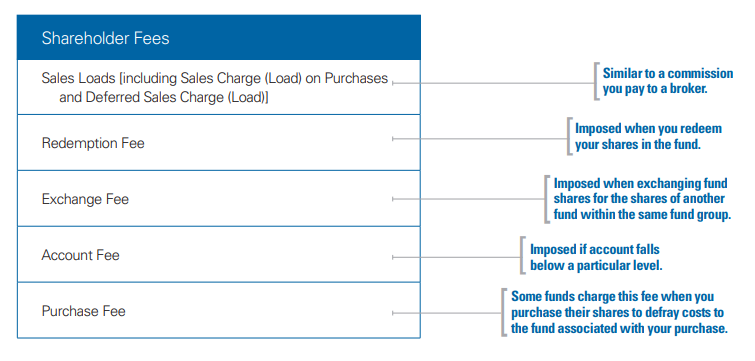

Shareholder fees are fees that some funds may charge directly to you during your transactions or periodically for account fees. The fund imposes these fees and is meant to cover the costs of managing your investment account and processing your transactions.

Shareholder fees can include various charges such as:

- Sales loads are charged when you buy or sell shares of a mutual fund and are typically expressed as a percentage of the amount invested.

- Redemption fees may be charged when you sell or redeem shares of a mutual fund within a certain period, and they are also usually expressed as a percentage of the amount redeemed.

- Exchange fees may be charged when you transfer shares from one fund to another within the same fund family.

- Account maintenance fees are periodic charges that cover the cost of managing your investment account and may be assessed annually or monthly.

It’s important to carefully review the prospectus and other fund documents to understand the specific shareholder fees that may apply to your investment.

(ii)Annual Fund Operating Expenses

Annual fund operating expenses are the regular and recurring charges that funds pay out of their assets rather than directly imposing them on you.

You’ll find these expenses in the annual fund operating expenses table, where you indirectly pay out of funds’ assets.

Some annual fund operating expenses include

- Management fees: Charged by the fund’s investment manager for managing the fund’s portfolio.

- Administrative fees: Cover fund administration costs, including recordkeeping, accounting, and legal expenses.

- Distribution fees: Paid to intermediaries for selling or promoting the fund’s shares.

Other expenses may include custodial, transfer agent, and audit fees. These expenses are calculated as a percentage of the fund’s average net assets and are reflected in the fund’s net asset value (NAV), which is the price at which you buy or sell shares of the fund.

It is essential to review the prospectus terms to understand the exact annual operating fund expenses for a particular mutual fund

Types of mutual funds

Investors can choose various types of mutual funds, each with its investment strategies and goals. Here are common types of mutual funds:

Equity funds

These funds invest in foreign stocks. They include;

- Index funds aim to replicate the performance of a specific index

- Actively managed funds, where a fund manager selects and manages the stocks in the portfolio

Equity funds are categorized based on the size of the companies they invest i.e.

(i) Small-cap, mid-cap, or large-cap

(ii) Investment objectives, like growth or income.

Fixed income funds

Fixed-income funds invest in investments paying a fixed rate of return, such as corporate and government bonds. The benefit of fixed-income funds is that they provide income generation to an investment portfolio.

Asset allocation funds

These funds allocate a specific portfolio amount to fixed income and equities based on the fund’s goal. They aim to provide a balanced approach to income and growth potential within a single fund.

Index funds

Index funds are investment funds that hold a collection of securities designed to closely replicate the performance of a specific market index, such as the S&P 500 index fund.

They are popular for their cost-effectiveness and simplicity in tracking an index, which can result in potential tax advantages compared to actively managed funds.

In addition, they are a straightforward option for investors seeking a passive approach to investing in the broader market.

Target date funds

These funds are an asset allocation fund where the mix of securities and asset classes, such as equities and fixed income, gradually shifts as the target date for needing the money, usually for retirement, approaches. They are designed to provide a diversified approach that automatically adjusts over time.

Money market funds

These funds allocate their investments to cash equivalents, such as U.S. Treasury bills and CDs. They are considered to have a lower risk than other types of mutual funds and offer a higher return than savings accounts. Note FDIC does not insure the money market fund.

Commodity funds

These funds invest in companies involved in commodity-intensive industries, such as energy exploration and mining. Commodity funds can serve as a hedge against inflation but can be more volatile than most stock funds.

Environmental, Social, and Governance (ESG) funds

These funds consider noneconomic principles, such as environmental responsibility, human rights, or religious views, in their selection and weighting of securities. ESG funds may also avoid investing in certain industries, such as defence, alcohol, tobacco, or gambling, based on their investment criteria.

The Bottom Line

A mutual fund is a professionally managed investment vehicle that pools money from multiple investors to invest in a diversified portfolio of securities. It offers an easy way for investors to access a diversified investment portfolio with professional management. However, when investing in mutual funds, it’s important to consider expenses and costs, such as shareholder fees and annual fund operating expenses.

There are various types of mutual funds, including equity, fixed income, money market, and index funds, each with its investment strategy and risk profile. Research and consult a financial advisor to choose the right mutual fund for your investment goals.

What are you waiting? Start investing in mutual funds today for potential long-term growth!

Mutual Fund FAQs

How does a mutual fund work?

A mutual fund pools money from multiple investors to invest in a diversified portfolio of securities, such as stocks, bonds, or other assets. The fund is managed by a professional fund manager who makes investment decisions on behalf of the investors. Investors own shares in the mutual fund, and their returns are proportional to its performance.

Are mutual funds a good investment?

Yes, mutual funds can be a great investment! They provide diversification, professional management, and access to various assets. They are suitable for investors seeking long-term growth and can help achieve financial goals with potentially higher returns compared to traditional savings accounts.

What is the minimum investment required to start investing in a mutual fund?

The minimum investment requirement varies depending on the mutual fund and can range from a few hundred to several thousand dollars. Some mutual funds also offer the option of making regular small investments through systematic investment plans (SIPs).

How do I choose the right mutual fund for my investment goals?

Choosing the right mutual fund involves considering factors such as your investment goals, risk tolerance, time horizon, and investment strategy. Before deciding, researching and comparing mutual funds based on their historical performance, risk profile, fees, and other factors is essential.

Can I lose money in a mutual fund?

Yes, mutual funds are subject to market risks, and the value of your investment can go down. It’s important to carefully evaluate the risks involved and diversify your investments to minimise the impact of potential losses.

How often can I buy or sell mutual fund shares?

Mutual funds are bought or sold on any business day, so you can buy or sell shares as frequently as you want. However, it’s essential to remember that frequent buying or selling of mutual fund shares may result in transaction fees or taxes, so it’s vital to consider the costs and potential impact on your investment returns.

How much money do I need to invest in mutual funds?

The minimum investment requirement for mutual funds varies depending on the fund, but it can range from as low as $1,000 to $5,000. Some funds also offer options for regular contributions with smaller amounts. It is best to check with the specific mutual fund company or financial advisor for their minimum investment requirements.