Budgeting is a crucial tool in financial planning, but understanding some key components of successful budgeting is essential. Budgeting helps you to track all your income and expenses to make wise decisions about your spending. Most income high-earners struggle with budgeting because of their surplus disposable income, thus, making them overspend. Budgeting doesn’t have to be complicated, with the right strategy, you can succeed in your finances.

While budgeting can feel daunting to those who want to track, spend and create plans to save money, creating a budget is empowering! Though budgeting can feel like constraining us from enjoying life, it give us control of inflow and outflows of our penny. All you need is to balance between spending and saving.

Budgeting is a vital tool to any household. By creating and sticking to a budget, families can allocate their spending wisely. Example, a budget will help you pay bills on time, allocate money for emergency funds, recreation, and food. Budgeting helps us know what is a need and what is a want. Thus, you become accountable and strategic on how to reach your financial goals.

In a world filled with financial uncertainties, a budget with a set side emergency makes it easier to weather unforeseen financial storms while you avoid debts. Budgeting helps you live within your means, have a peace of mind and ensure you don’t pay high interest fees. It also helps you avoid poor credit rating incase you default. In addition, with a budget, you can plan for a vacation, purchase a home, save for retirement, etc. That said, you can save and invest for the future.

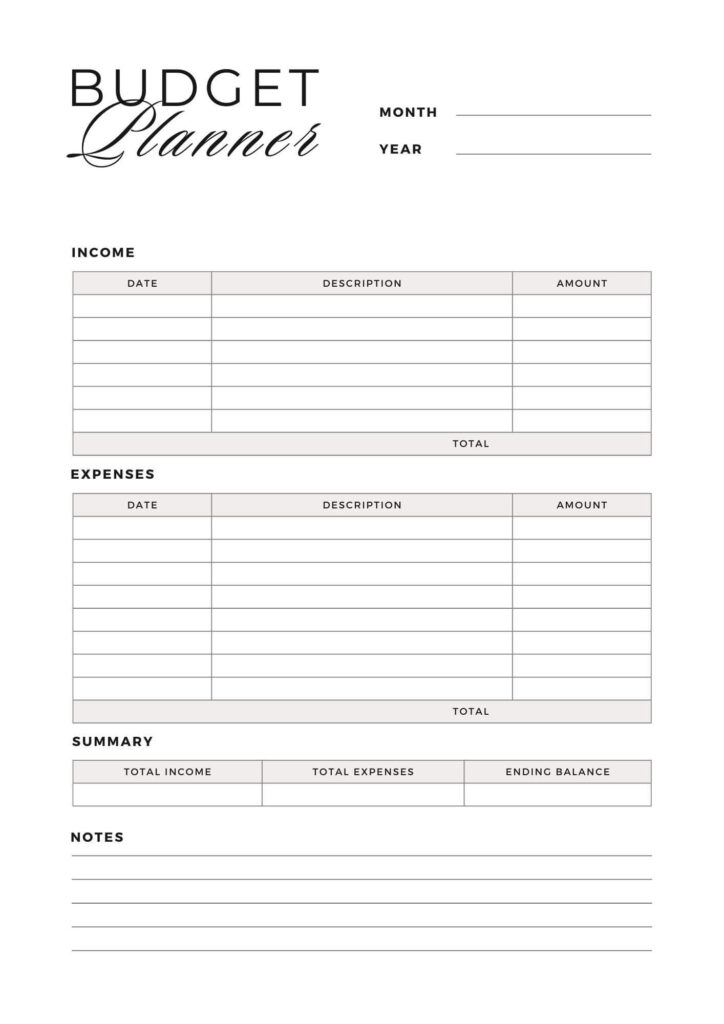

Even though sticking to a budget is hard, creating and following one is rewarding. The first step is to have clear goals within a specific timeframe; list down all your income and expenses then evaluate between needs and wants. Ensure you adjust where necessary to match your goals.

Next, set a system to help you keep track of your goals, you may use app such as You Need A Budget(YNAB), Mint, etc. Creating an effective budget and sticking to it is vital to all individuals.

Here are some key components of successful budgeting:

1.Calculate Your Monthly Income

To start budgeting, you need to figure out how much money you earn each month. This includes your salary, any income from investments, and any other money that comes in regularly. Knowing your total income is the first step in managing your finances effectively.

2.Set Your Financial Goals

Successful budgeting begins with clear goals. What do you want to achieve with your money? Whether it’s saving for a house, paying off loans, or building an emergency fund, having specific goals will guide your budget. Determine how much money you need to put towards these goals each month.

3.Monitor Your Spending

Keep track of your expenses for at least a month. This means recording everything you spend money on. You can use budgeting apps or simply jot it down with pen and paper. Tracking your spending helps you understand where your money is going and where you can cut back.

4.Organize Your Expenses

Once you’ve monitored your spending, organise your expenses into categories. This makes it easier to see which areas consume most of your money. Typical categories include housing, groceries, transportation, entertainment, and paying off debts.

5.Set Spending Limits

After categorising your expenses, establish limits for each category. For example, you might decide not to spend more than $300 on groceries each month. These limits ensure you stay within your budget and prevent overspending.

6.Make Adjustments When Necessary

Remember, budgets aren’t set in stone; they should adapt to changes in your life. As your income or expenses fluctuate, be ready to adjust your budget accordingly. This ensures your budget remains a true reflection of your financial situation.

7.Build an Emergency Fund

A crucial element of a successful budget is having an emergency fund. This money acts as a safety net for unexpected situations, like losing your job or facing unexpected medical bills. An emergency fund safeguards you from going into debt when life throws surprises your way.

8.Stick to Your Plan

Once you’ve created your budget, it’s vital to stick to it. This means following the spending guidelines you’ve outlined and resisting the temptation to overspend. If you find it challenging to stay on track, there are resources available to provide support and keep you accountable.

9.Stay Flexible

Flexibility is key to successful budgeting. Some months you might overspend or encounter unforeseen expenses. Don’t be too hard on yourself when this happens. Instead, adjust your budget for the following month and get back on the financial track. It’s all part of the budgeting journey.

Incorporating these steps into your budgeting process will help you gain control over your finances, prepare for the unexpected, and stay on the path to achieving your financial goals.