Social Security is the major source of income for most elderly Americans. In 2023, almost 67 million Americans per month received Social Security benefits, totalling over one trillion dollars in paid benefits.

According to the SSA, as of December 31, 2022, nine out of ten people aged 65 and above were receiving retirement benefits. With 12% of men and 15% of women relying on spousal benefits for 90% of their income. 37% of men and 42% of women receive 50% of their income from Social Security.

Learn more about the average Social Security benefits, check by the recipient, maximum benefit amount, and what factors influence it.

Average Social Security Check by Recipient

Social security benefits is not just for retirees, it benefits minor children of deceased workers, retirees children and spouses, and the disabled. Each month, a retired worker receives an average of $1,840.26 The amount received varies from one recipient to the other.

According to SSA, as of July 2023, the benefits were:

- Retirement benefits (78.2%) receive an average monthly benefit of $1,788.89

- Survivor benefits (8.8) receive an average monthly benefit of $1,713.36

- Disability insurance (13.1) receives average monthly benefits of $1,486.42

If you file for early retirement, you will receive fewer checks at retirement age. Note that you must pay 6.2% Social Security taxes on your income, while your employer pays another 6.2% of your salary to receive these benefits. If you are self-employed, you’ll have to pay two taxes.

What is the Maximum Monthly Social Security Benefit?

Your average Social Security benefits are based on your lifetime earnings. The amount you receive depends on factors such as your earnings history and when you receive the benefits. Research shows that the number of Americans aged 70 and older will increase to 76 million by 2035. As of December 2021, the average social security benefit for age 70 was $1,768.94 and $1,963.48 by December 2022, showing an increase of 11%.

As of 2023, according to the Social Security Administration, the average Social Security retirement benefit per month is $1,827. The maximum a retiree can get monthly is $3,627 at Full Retirement age (FRA). Individually, you can maximize your benefits by delaying filing for retirement until age 70, which is the latest age to file for retirement benefits, and taking advantage of spousal benefits and survivor benefits.

How Do I Know My Earnings?

The easiest way to know your earnings is to check via your online Social Security account or calculate using the Social Security Benefits Calculator. It’d help you know your monthly benefits if you started Social Security at age 62 or 70.

Note that the actual benefits you’ll receive may vary depending on the cost-of-living adjustment (COLA), fluctuations in your earnings, and changes in the Social Security law.

Here’s the maximum monthly benefit by retirement age for 2023:

- Age 62: $2,572

- Age 65: $3,279

- Age 66: $3,506

- Age 70: $4,555

Calculating Your Benefit Amount

Calculating your average social security benefits involves a simple three-step process that relies on your earnings record.

1. Adjusting your earnings

The Social Security Administration (SSA) adjusts your earnings for historical changes in U.S. wages and identifies your 35 highest-earning years to produce your average indexed monthly earnings (AIME). The SSA only considers income up to the maximum taxable earnings, which are currently set at $160,200 for 2023.

2. Determine PIA

The SSA then applies a formula to determine your primary insurance amount (PIA), or the amount you’ll receive each month if you claim benefits at your full retirement age. This formula breaks down your average monthly wage into three parts: 90 percent of the first $1,115 of your AIME, 32 percent of any amount over $1,115 up to $6,721, and 15 percent of any amount over $6,721. The formula is designed to weigh the benefits in favour of low-wage earners, who need retirement money the most.

3. Factoring the age to claim benefits

Finally, the SSA factors in the age at which you claim benefits. If you claim benefits before your full retirement age, your average social security benefits will be reduced, and if you delay claiming benefits until after your full retirement age, your benefits will be increased.

It’s worth noting that the SSA recalculates your benefit amount annually, adjusting for inflation and factoring in the previous year’s income. If your income in a given year ranks among your top 35 years of earnings, the SSA will replace a lower-earning year, increasing your average monthly earnings figure. And if you worked fewer than 35 years, the SSA will credit you with zero earnings for each year up to 35.

Cost of Living Adjustments Rise Benefits

Social Security depends on the earnings paid on Social Security payroll taxes. The higher the earnings, the higher the benefits. The maximum taxable amount in 2023 is $160,200.

Due to that, most employers have shifted from traditional pension plans to defined contribution plans like 401(k), which pay depending on workers’ contributions. Therefore, Social Security is the only source providing guaranteed retirement income that is not subject to financial market fluctuations and other investment risks.

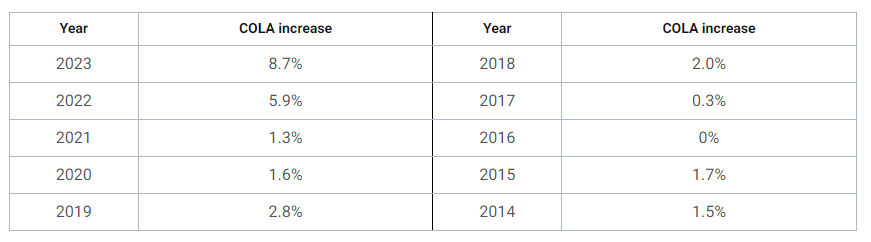

COLA increase depends on the Consumer Price Index. Due to high inflation in 2023, the COLA adjustment is at 8.7% as of January, increasing average social security benefits for retired workers by $146 per month. This indicates a huge difference compared to 1.6% in 2020, 1.3% in 2021, and 5.9% in 2022.

Effects of COLA rise

If you’re currently receiving Social Security benefits and a cost-of-living increase is on the way, you might not see the entire increase reflected in your payment. This could be because your Medicare Part B premiums are being deducted from your Social Security payment, which happens to 70 percent of Part B enrollees. If Medicare rates increase, it could reduce your payment despite the COLA increase.

But don’t fret! The good news is that you can look forward to some relief in 2023. Despite the cost-of-living increase, Part B costs will actually drop, which is a rare occurrence. This means you can expect to see a boost in your payment without worrying about a reduction due to increased Medicare rates.

The table below shows the COLA level of adjustments in the past decades.

Source: Social Security Administration

Conclusion

Social Security benefits can be a critical source of income during retirement, and it’s important to understand how they work and how to maximize your benefit amount. By understanding the factors that influence your benefit amount and using strategies to maximize your benefits, you can ensure that you receive the maximum benefit amount possible. We hope that this guide has been helpful in understanding the Average Social Security Benefit at age 70 and how to calculate your benefit.