Investing in stocks for beginners with little money may be a great way to grow wealth.

Online investment accounts, and brokers offer the opportunity to start stock investing with a single share.

Learn how to invest in the stock market with little money.

Investing in stocks can vary based on individual preferences. As a new investor, you need to decide whether to invest in individual stocks or stock funds.

It’s essential to set a budget, have a long-term perspective, and regularly monitor and adjust your portfolio as needed.

Here are steps to investing in the stocks for Beginners with little money:

#1. Educate yourself on the stock market and investing basics

The first step is to learn about the stock market and investing basics to make informed investment decisions and maximize potential returns. It includes understanding terms such as stock types, market trends, diversification, and risk management.

Resources for learning the stock market and investing basics include financial literacy courses, books, and online tutorials. In addition, you may seek advice from expert advisors, robo-advisors, and online brokers.

#2. Investing in stocks approach

Once you’ve familiarized yourself with stock market terminology and investing lingo, it’s time to decide how you want to invest.

There are various options for investors to invest in the stock market. Here are a few tips to help you choose the best strategy. Select the one that best describes you.

- I have time, but I’d prefer a financial advisor.

- I don’t have time I’d like someone to process it for me

- I have enough time to analyse the stock market and do it myself

What are the best ways to invest in the stock market?

Here are the common ways to invest in the stock market:

Robo-advisor

A robot advisor is an automated investment platform that uses algorithms to build and manage portfolios on your behalf. It considers factors such as investment goals, risk tolerance, and more to create a portfolio. It executes trades and manages the portfolio, with a focus on tax-efficiency and rebalancing.

Individual stocks

Investing in individual stocks is suitable only for those who have the time and interest to research and continuously evaluate stocks. It carries a higher risk than diversified investments but can offer higher returns if the selected company performs well.

Index funds

Another option for investing in stocks is Index funds.They offer a passively managed investment option with lower costs compared to actively managed funds. Index funds track the performance of stocks, such as the S&P 500.

The S&P 500 has had an average annual return of about 10%, which has the potential to generate substantial wealth over time.

By investing in an index fund, individuals gain diversified exposure to a broad range of stocks, reducing their overall investment risk.

#3. Deciding how much to invest in stocks

Investing in stocks involves factors such as your goals, risk tolerance, and time horizon. The stock market is often unstable in the short term, with a yearly decline of 20% frequently occurring.

For example, in 2020, during the COVID-19 pandemic, the stock market saw a drop of over 40%.

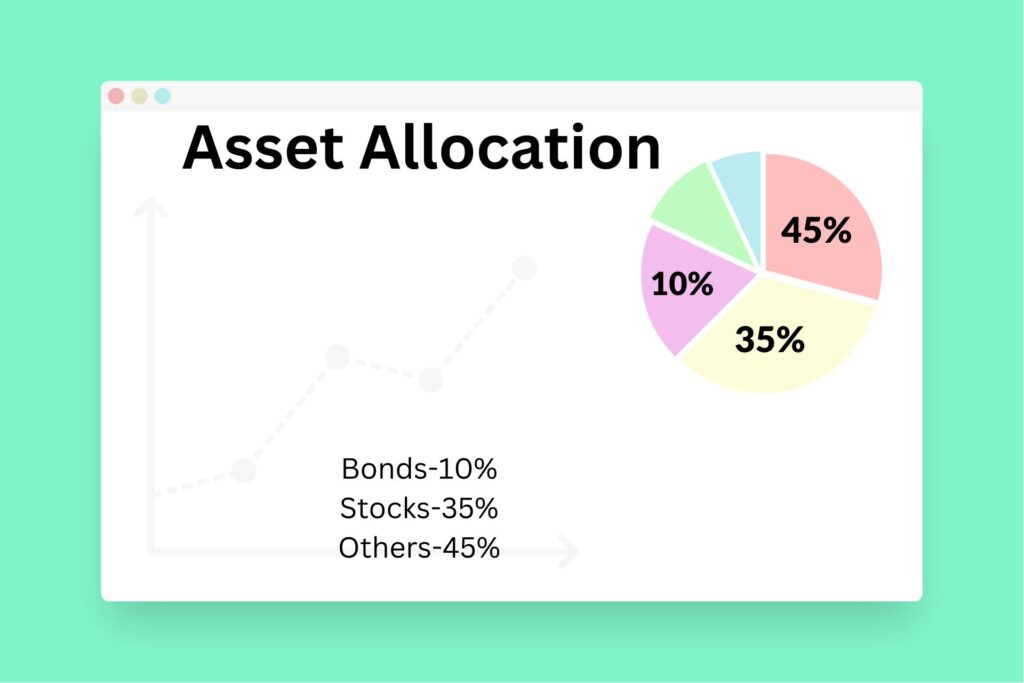

That’s why it’s crucial to consider asset allocation before investing in stocks. The higher the risk, the greater the potential reward.

Increase your stock allocation if you’re willing to take on more volatility for higher potential gains. Conversely, reduce your stock allocation if you prefer more stability in your investments with lower potential returns.

What is asset allocation?

Asset allocation divides an investment portfolio into asset categories, such as stocks, bonds, and cash. The strategy balances risk and reward by considering an investor’s goals, risk tolerance, and investment time horizon.

#4. Open a brokerage account

The next step is to open a brokerage account. Opening a brokerage account is crucial for anyone investing in stocks. With a brokerage account, you can buy and sell stocks, exchange-traded funds (ETFs), and other securities.

To open a brokerage account, you must choose a reputable broker that aligns with your investment goals. Some reputable brokers include Charles Schwab, TD Ameritrade, E*Trade, and more.

Before opening a brokerage account, it’s important to consider each broker’s fees and services. In addition, their reputation and track record in the industry.

Once you’ve identified a reputable broker, complete an application with your personal and financial information. You will also be required to complete a brokerage agreement, which outlines the terms and conditions of your account. Ensure you’ve read and understood the terms and conditions, as they vary between brokers.

Types of Brokerage Accounts

There are two main brokerage accounts:

A standard brokerage account: An investment account that allows individuals to buy and sell various securities, including stocks, bonds, and mutual funds. It offers a convenient and accessible way for individuals to invest their money and potentially grow their wealth.

An Individual Retirement Account (IRA): IRAs are investment accounts that offer tax benefits for individuals saving for retirement. They come in two main forms: traditional and Roth IRAs. And also have specialized options such as the SEP IRA and SIMPLE IRA for self-employed individuals and small business owners. Accessing money stored in IRAs before retirement age can be challenging, despite their tax advantages.

#5. Choosing stocks

Choosing stocks involves a thorough evaluation process to determine the potential of an investment.

Here are some key factors to consider when choosing your stocks.

Define investment goals and risk tolerance

Before investing in stocks, you must clearly understand your financial goals and the level of risk you are comfortable with. This will help guide your investment decisions and ensure that your investments align with your objectives.

Market research

Conduct research to identify potential stocks using tools such as stock screeners and financial websites. Look for stocks with strong performance metrics and growth potential and are well positioned in their industry.

Evaluate financial health

Carefully evaluate the financial health and performance of companies you are considering investing in. Look at revenue, earnings, growth potentials, and any potential red flags, such as debt levels and declining sales.

Consider industry trends and future growth

Look at the industry trends and future growth prospects for the companies you are considering. This will give you a better understanding of the company’s competitive position and potential for future growth.

Valuation and diversification

Consider the stock’s valuation compared to others in the same sector and diversify your portfolio to minimize risk. Diversifying your portfolio means investing in a range of different stocks, industries, and asset classes. It helps to reduce your overall risk exposure.

#6. Managing your stock portfolio

Managing a stock portfolio requires a systematic approach and ongoing monitoring to ensure it remains aligned with your goals. Reviewing your portfolio a few times a year can help you assess whether you need to make any adjustments.

These include

- shifting investments to more conservative options as you approach retirement

- increasing diversification across different sectors and regions.

Diversification is key to reducing risk and maximizing returns. By following a structured process for choosing and monitoring stocks, you can make informed investment decisions and achieve your financial goals.