Here are the details about GST Voucher payout date Singapore 2024, eligibility, how much GST Voucher to get 2024.

When Is Singapore GST Voucher Payout Date 2024?

The government of Singapore has announced the release of GST Voucher Payout come August 1st, 2024. Payment will be made via various method. Recipients using PayNow-NRIC bank connected accounts will get their payment between August 1st and August 21st, 2024.

According to the Ministry of Finance (MOF), approximately 1.5 million eligible singaporeans may receive more money as annual GST Plan. Beneficiaries will receive $450 or $850 in cash based on their Annual Value of household.

Singapore citizens who haven’t applied are urged to fill out forms for GST Voucher benefits. Please keep reading to learn details about GST Voucher payout dates and paychecks eligibility.

Who Is Eligible for August Cash Payout?

Singaporeans aged 21 and above with an assessable income of up to $34,000 for the year assessment 2023.

The Goods and Services Tax (GST) Voucher payout is a program to help low- and middle-income Singaporeans living in Singapore with their daily expenses. It was first introduced by the Singapore Government in 2012. Eligible Singapore citizens will get payouts depending on specific criteria and application procedures set by the government.

GST Voucher Overview

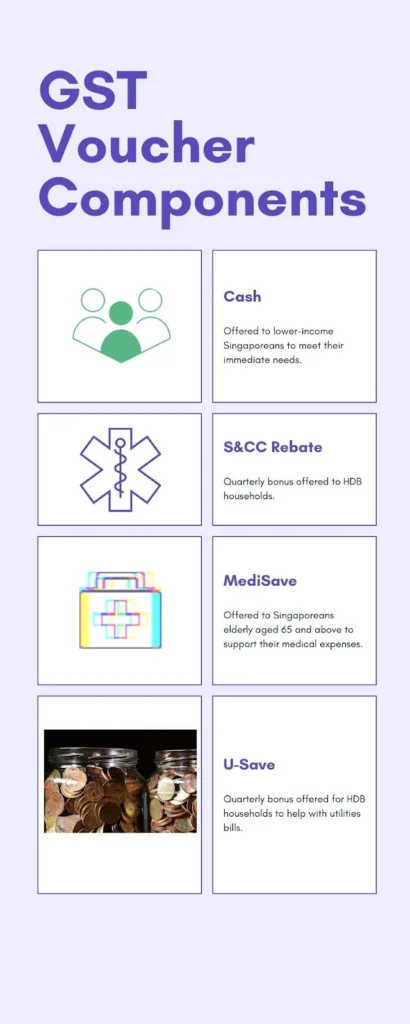

GST Voucher has four components:

- MediSave: A bonus offered to Singaporeans elderly aged 65 and above. The benefit is deposited directly into their CPF MediSave account to support their medical expenses. The payment is made in August each year.

- S&CC Rebate: Quarterly bonus offered to HDB households to offset their Service and Conservancy Charges ( S&CC) rebate. Paid each year in January, April, July, and October.

- U-Save: Quarterly bonus offered for HDB households to help with utilities bills. The benefit is paid each year in January, April, July, and October.

- Cash: Offered to lower -income Singaporeans to meet their immediate need. Paid each year in August.

GST Voucher Payout Date 2024

GST Voucher Payout Date 2024 is set to be between 1st and 21st August 2024.

These GST Voucher cash components will depend on your payment method.

GST Voucher Payout 2024 Payment Method

- PayNow-NRIC linked bank account: The PayNow-NRIC is the most recommended payment method. Individuals who have their NRIC linked to a PayNow with a local or a foreign PayNow-GIRO-participating bank in Singapore will receive their GST Voucher payouts directly into their bank account on 1 August 2024.

- Bank Credit: Singapore citizens who gave out their UOB, OCBC, or DBS/POSB bank account details to the government, their GSTV-Cash will be deposited directly to their account on 11 August 2024.

- GovCash: Individuals who don’t have a linked PayNow-NRIC to a bank account, or have not provided bank account details, GSTV-Cash will be directly deposited into their GovCash account on 21 August 2024. They can withdraw from any OCBC ATM islandwide.

It is important to note that Singaporeans who have not applied for the payouts, have until 30 April 2024 to sign up for GSTV or update their payment details via the GSTV e-services portal.

GSTV Enhanced Cash Payouts

In 2024, eligible Singaporeans will receive a cash payout of $450 up to $850 compared to $350 – $700 in 2023.

You Might also like:

Payouts payment will be in August each year. Low-income households will get a large portion of the benefits.

2024 GST Voucher Payout Overview

| Singaporeans 21 years and above in 2024, AI up to$34,000 for YA2023 | |

| Property Ownership: 0 to 1 property | |

| AV of Home as at 31st December 2023 | GSTV-Cash to be paid from August 2024 |

| Up to $21,000 | $850 |

| $21,001 – $25,000 | $450 |

2023 GST Voucher Payout Overview

| Singaporeans 21 years and above in 2023, AI up to$34,000 for YA2022 | |

| Property Ownership: 0 to 1 property | |

| AV of Home as at 31st December 2023 | GSTV-Cash to be paid from August 2023 |

| Up to $13,000 | $700 |

| $13,001 – $21,000 | $350 |

Singapore GST Vouchers 2024 Eligibility

Acoording to the Finance Ministry, eligible citizens who have signed up for government disbursement schemes, MediSave and Cash GSTV will be sent immediately. To receive GSTV-Cash 2024 individuals must meet specific criteria.

Here are GST Voucher 2024 Eligibility criteria:

- Residency & Citizenship: Must be a Singapore citizen, Singapore permanent resident residing as of 31 December 2023

- Age: Must be 21 years or above in 2024

- Income: Annual income in 2022 assessed by IRAS for Year of Assessment 2023(YA2023) must not exceed $34,000

- Annual Value of Home: The Annual Value (AV) of your home must not exceed $21,000 as indicated on your NRIC.

- Property Ownership: Individuals must not own more than one property.

How to Apply for GST Voucher 2024 Payout in Singapore?

2024 GST Voucher payout is automatic, you don’t need to apply . If you received a GST Voucher 2023 payout and you meet 2024 eligibility criteria, you’re going to receive the enhanced cash payouts in August 2024.

Singaporean citizen or permanent resident, age 21 years old and have an AV of $21,000, or less and an annual income of $34,000, or less in 2022 and have never done before, you can visit GSTV e-services site and sign up.

- If you’ve changed your bank account details, contact information, or property ownership status since your last registration, you need to update them via GST Voucher e-services portal by 30th April 2024.

- If you have not filed your income tax for the YA2023, ensure you file before the deadline to avoid delaying your GST Voucher cash.

GST Voucher Payout Frequently Asked Questions

How much GST Voucher will I get 2024?

Up to $850. To help lower income Singapore citizens with their daily expenses, the government will be disbursing cash payouts of up to $850 in August every year.

How to check government payout Singapore?

- Login to your Singpass

- Select “My Profile”

- Click “View all”

- Select “NS Benefits”

- Your total payout and balance will display.