Approximately 2.5 million Singaporeans aged 21 and above will benefit from the Singapore Cost-of-Living Support Package 2024. The Singapore Government has announced a suite of support measures as at Budget 2024. This is to financially assist low income households to cope with the high cost of living due to inflation.

The payments will include a $1.9 billion enhancement to the Assurance Package, additional CDC Vouchers, rebates and cash payouts. In addition, workers training allowances and SkillsFuture Credit top-ups. Also, seniors will receive additional retirement and healthcare boost as part of the Majulah Package.

Keep reading to learn more about the Cost-of-Living Support Package 2024 in Singapore.

Cost-of-Living Support Package Singapore

The Cost-of-Living Support Package was first released in 2020 as a $6 billion measure to cope with the impact of GST hike (Goods and Services Tax). At Budget 2022, the package was topped up by $640 million and by $3 billion at Budget 2023.

As on February 17, 2024 Mr Lawrence said, “GST Voucher Fund will be raised by $6 billion to permanently defray GST expense for lower- and Middle-income households” .

According to Mr. Wong, the Assurance Support Package is mainly to help lower income families and larger households to cope with high cost of living,especially those families with children and seniors. If you have been receiving payments before you qualify for SG Cost-of-Living Support Package Benefits 2024. Those who have not yet received can check SG COL Special Payment Eligibility 2024.

What Is the Cost-of-Living Support Package for Singapore In 2024?

Bolstering economic recovery and enhancing social resilience. Thus, helping Singaporeans to cope with increased wage bills, rental fees, utilities and supplies costs.

Cost-of-Living Support Package 2024 Singapore Payment

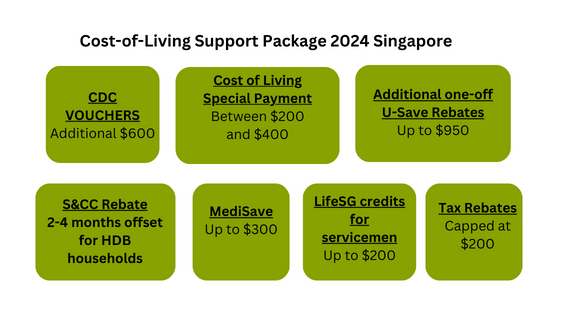

Here’s an overview of SG COL Support Package Benefits 2024. The COL Support Package Amount varies from $200 to $950 as per each situation.

1. CDC Vouchers

About 1.4 million Singaporean households will benefit from CDC Vouchers payment 2024.

Each Singaporean household will get an extra $600 in CDC voucher whereby half will get distributed by the end of June and the remaining half starting January 2025.

Singapore citizens will deem those vouchers at participating supermarkets, merchants, or hawkers.

2. COL Special Payment

Approximately 2.5 million Singaporeans will get cash payment from SG Cost-of-Living Special payment. Come September 2024, Singaporeans aged 21 and above will get a one-off cash support of $200 Up to $400.

Singapore citizens earning less than $22,000 yearly will get $400. Individuals who earn $22,000 Up to $34,000 will get a cash payment of up to $300, while Singaporeans earning from $34,000 Up to $100,000 yearly will get a cash payment of $200.

To qualify for SG COL special payment 2024, one must have an assessable annual income not more than $100,000, and own only one property.

3. Additional One-off U Save Rebates

In 2024, Housing and Development Board (HDB) will get an extra U-Save rebate payment. About 950,000 Singaporean households are expected to receive these rebates.

Based on the HDB flat type, each household will receive $950 in U-Save rebates from the enhancements at the 2024 Budget. For the regular GST Voucher U-save and the U-Save are under the 2023-2026 Assurance Package

Singaporean households who live in HDB, whose members don’t own more than one property, will get 2.5 times the amount of regular GST Voucher U-Save rebates in 2024 financial year.

These rebates will be disbursed out in April, July and October year 2024, and in January 2025.

4. S&CC Rebates

Eligible HDB Singaporeans households will receive an extra one-off Service and Conservancy Charges (S&CC) rebates.

Singaporeans households who live in one or two room HDB flats qualify for four months of S&CC rebate. If living in a three or four room flat, you qualify for three months’ worth.

With Singaporeans households living in larger flats receiving 2.0 to 2.5 months of S&CC rebates. The S&CC rebate will get disbursed in four phases;April, July and October 2024, and in January 2025 same as U-Save rebates.

5. MediSaves

According to Mr Wong, Singaporeans aged 21 to 50 will get a one-time off $300 MediSave bonus in their Central Provident account. This includes Assurance Package and GST Voucher enhancements. Payment amount will depend on the individual year of birth, property owned, and annual value of their residence.

Singapore citizens born between 1974-1983 will get a $300 bonus if they own less than one property with less than $25,000 annual value. Singaporeans born in 1984 to 2003 will get $200 if they own less than one property, with less than $25,000 annual value.

Those Singaporeans owning more than one property or whose property annual value is more than $25,000 will get a bonus amounting $100 less than their counterparts born in the same year.

Those Singaporeans born in 1973 between the age of 50s and the early 60s will receive a one-time MediSave bonus as part of the Majulah Package. Singaporeans below 50s will get a higher tier of $1,500 while others will receive $750.

This bonus will benefit 1.4 million Singaporeans to assist them cover expenses such as insurance premiums and medical bills. The bonus will cost the Government $0.3 billion.

6. LifeSG Credits for Servicemen

In November 2024, all national servicemen will get $200 in their LifeSG credits. This is as well for National Servicemen eligible for graduating Dec 31 this year.

This bonus will cost the government $240 million. The credit can be used to buy goods and services at physical and online merchants offering PayNow UEN QR or Nets QR payment, or both using the LifeSG mobile application.

Approximately 1.2 million national servicemen will benefit from this.

7. Tax rebates

Singaporeans will get a 50 per cent personal income tax rebate for the 2024 year assessment. According to Mr Wong, the rebate will be capped at $200 to benefit middle-income workers. In addition, those with dependants can also get dependent-related relief schemes.

Annual dependent income threshold will increase from $4,000 to $8,000 for the year of assessment 2025. So, a caregiver or parent can claim dependent-related tax relief under this new threshold as long as their dependents are earning annual income of $8,000 and below.

The rebate will cost the Government S$350 million.

Cost-of-Living Support Package 2024 Singapore Eligibility

To receive COL Support Package you need to meet specific eligibility criteria. You’re eligible for the COL Payment 2024 if:

- Age: Singaporeans aged 21 years and above in year 2024

- Residency: Should be a Singapore resident

- Property ownership: Don’t own more than one property

- Income Limit: Earn Assessable Income Up to $100,000

Cost-of-Living Support Package 2024 Singapore Dates

As per Budget 2024, Singapore Government will provide more support for households, including the B2024 COL Special Payment. Eligible Singaporeans will benefit in the subsequent B2024 COL Support Package.

- Eligible Singapore citizens will receive SG COL Payment Amount 2024 in September.

- Payment will be transferred to eligible individual NRIC Linked Bank Account

- Singaporeans who qualify will get a one-off cash payment of $200 up to $800.