Budgeting Apps are the best way to stay on top of your finances. These Apps help you track your spending and set goals, so you don’t waste money.

You’ll be able to see where every penny goes and make better decisions about how to spend in the future.

With these best budgeting apps, you’ll manage your cash flow and monitor upcoming bills. Also, let you know when it’s time to buy groceries or gas!

The Best Budget Apps

- PocketGuard: Best Overall Budget App

- Mint: Best Free Budgeting App

- Youneedabudget (YNAB): Best Category-based Budgeting App

- Debt Free: Best All-inclusive Budgeting App

- Empower: Best spending tracker App

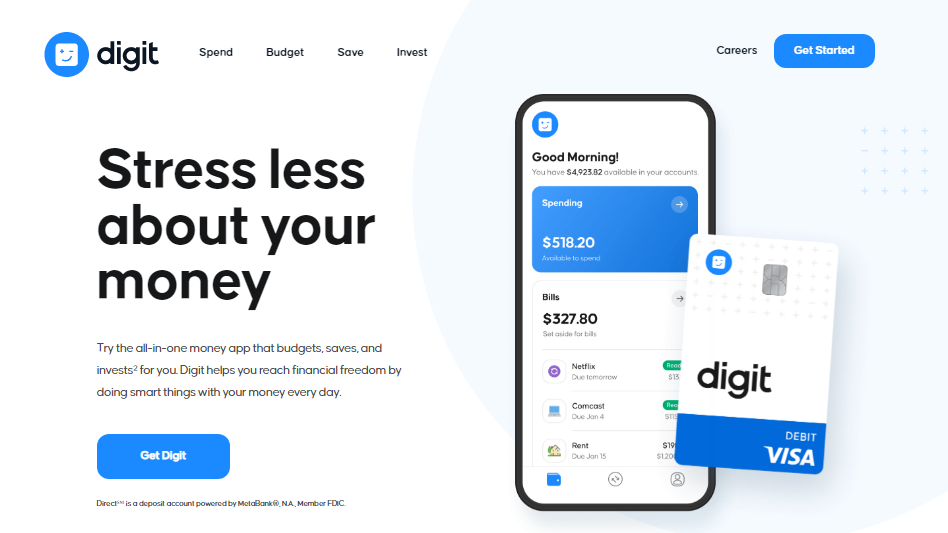

- Digit: Best Budgeting App for Saving & Investment

- Honeydue: Best budget App for couples

1. PocketGuard: Best Overall Budget App

PocketGuard is the best budget app for personal finance. With over 8,000 ratings on the Google Play and Apple store, it emerges as our best overall budget app. It serves as a simple budgeting tool. The “In My Pocket” feature shows you how much money are your bills and account balances; in a customized pie chart. It also allows you to adjust spending limits.

With PocketGuard, you can connect your credit cards, savings account and investment accounts. Also, when it comes to financial accounts, it allows you to track financial transactions manually. In addition, PocketGuard helps to customize debt repayment plans, set saving goals, bill negotiation, and cancel subscriptions.

Note that PocketGuard limits some of its budgeting features in the free version. Features such as creating spending categories and tracking cash flow are paid version (PocketGuard Plus).

Features:

- Pie chart reports

- Bill negotiation

- Personal spending categories

- Debt payoff plan

Pros

- Ability to link financial accounts

- Allow you to create customized budgets

Cons

- Most features are not available in the free version.

Rating

- Apple store – 4.7

- Google Play – 3.7

Pricing

- Basic PocketGuard: Free

- PocketGuard Plus: $7.99 per month or $79.99 per year

- PocketGuard Lifetime membership: $99.99

2. Mint: Best Free Budgeting App

If you’re looking for the best free budgeting apps, the Mint budgeting app is free, easy to use, and creates multiple goals. With Mint, you can link your bank account, making a budget for your spending. The premium version has a monthly subscription fee. Mint premium has great features such as specialized analysis of your spending.

Mint is a free money management app from intuit, the company behind QuickBooks and TurboTax. It helps you split expenses into several categories.

Mint uses your financial data to make better decisions, set savings goals, stay within budget constraints and track your income versus expenses. If there is unused from the previous months’ budget, it’ll carry forward to the next month.

Features:

- Bill payment tracker

- Budgeting goal tracker

- Free credit score

- Investment tracker

Pros

- Supports budgets across multiple accounts

- Categories everyday spending

- Keeps track of net worth and debt

- The App is FREE!

Cons

- Too many Ads

- Connectivity issues

Rating

- Apple store – 4.8 stars

- Google Play – 4.4stars

Pricing

- Mint is 100% free to use

3. You Need A Budget (YNAB): Best Category-based Budgeting App

YNAB is a zero-based budgeting app that lets you categorize your spending and calculate the balance in advance. It also offers its users educational resources on how to use it.

YNAB also has a clean interface, so you don’t have to worry about cluttering your phone with unimportant tasks. In addition, a list of goals gets tracked by personal urgency and importance to improve efficiency.

With YNAB App, you can connect a saving account and credit cards. Also, it allows students one year of free use.

It is available on iPad, Apple Watch, phone, Alexa, and desktop, one of the few category-based money management systems.

Features

- Goal tracker

- Spending and Net worth Reports

- Real-Time Sync

- Loan Calculator

Pros

- Easy setup mode

- Split transactions

- Widgets

- Multiple budgets

Cons

- Does not upload files from Dropbox

- Many Ads

Rating

- Apple Store – 4.8 stars

- Google Play – 4.6 stars

Pricing

YNAB costs $14.99 per month or $98.99 per year.

4. Debt Free: Best All-inclusive Budgeting App

Debt Free is an all-inclusive budgeting software millions of people have used worldwide.

Though Debt Free is a powerful tool, it’s pretty easy to use with its online interface and mobile application. Thus, money tracking seamlessly, whether at home or on the go!

Features

- Percent Paid Progress Bar

- Pay Off Strategies

- Debt Payment Tracker

- Mortgage Overhead Cost Tracker

Pros

- Set payment due dates notifications

- Track an unlimited debt

- Supports credit card promotional APRs

- Built-in Payoff date calculator

Cons

- It doesn’t credit payment in the payment schedule

Rating

- Apple store – 4.3 stars

- Google Play – 4.1 stars

Pricing

Premium version goes at $0.99

5. Empower: Best Budgeting Spending Tracker App

Empower is perfect for someone serious about creating a life you love. It helps you build the life you want by paying closer attention to how and when you spend your time.

Empower offers an investment fee analyzer, cash flow tracking, investment checkup, financial planning, and a net worth tracker.

It is the best free app for investment or personal goals. With Empower, you can connect credit cards, IRAs, loans, and mortgages.

It has a user-friendly interface. Empower is available on both Android and iOS.

Features

- Fee analyzer

- Retirement planner

- Net worth planner

Pros

- Personal cash capital

- Short-term and long-term financial goal features

- Net worth and transactions analytics

- Investment portfolio performance tracker

Cons

- Limited user interface

- $100,000 minimum portfolio management balance service

Rating

- Apple store – 4.7 stars

- Google Play – 4.3 stars

Pricing

It is free to download and use

6. Digit: Best Budgeting App for Saving & Investing

Digit helps you save towards your goals by keeping aside a certain amount. It uses machine learning to in guiding you.

With Digit, you only need to input the amount you want to save and your hit mark. The best thing about it is that you can set several goals.

Digit can help you budget for your debts. It moves funds into student loans or credit cards by selecting the suitable amount.

It is available on iOS, Android, and the Web. It also has a user-friendly interface.

Features

- Credit card debt reduction feature

- Up to $250,000 FDIC insured

- Overdraft protection and reimbursement

- Checking account

Pros

- Quick and easy sign-up

- Saving bonus

- Automatic payment using your credit card

- Unlimited withdrawals & no account minimums

Cons

- It does not offer interest

- Has a monthly fee

Rating

- Apple store – 4.7 stars

- Google Play – 4.5 stars

Pricing

It has a 30-days free trial after you pay $5 monthly.

7. Honeydue: Best budget App for couples

Honeydue app is one of the best free budget app for couples who need to take control of their money. This mobile app allows couples to chat within it about their finances and expenses, and also lets you send emojis. It serves over 20,000 different financial institutions, allowing couples to integrate their bank accounts.

It also sends couples reminders for upcoming bills and lets them set monthly limits. Moreover, it allows couples split expenses evenly, or one partner to be responsible for the expenses. The best part is that you and your partner can open a joint bank account, that is FDIC-insured through Sutton Bank.

Honeydue joint account is free to open; no fees nor minimums. In addition, it comes with a free debit card that can access 55,000+ surcharge-free ATMs, and Google Pay and Apple Pay. Overall, whether your goal is saving for a vacation or growing your emergency fund, Honeydue is the right budget app for couples.

Features

- Transparency

- Chat directly within the app

- Alerts within the app about expenses

Pros

- Free to open

- No minimum balances

- Joint account FDIC-insured with free debit card

Cons

- There should introduce desktop version

Rating

- Apple Store – 4.5

- Google Play – 3.3

Pricing

- It is free to download and use

How To Choose a Budgeting App

How to choose a budgeting app varies from one person to another. The best budgeting apps have several features depending on your goals and needs. Here are some considerations when choosing one.

Security

Security is the first urgent consideration when choosing a budgeting app. Though apps have tight security, some may not. Features like multi-factor authentication, secure WI-FI network, and 256- bit encrypt are key features to pay attention to.

Fees

While some budgeting apps are free to use and download, others have a monthly fee. It would be wise to compare and select the one that fits your needs. Whether free or paid, the main purpose is to help you budget your finances.

Customer service

Money is sensitive; quick-to-act customer service would be the best choice. Look at the app’s customer service, both from the desktop and android. Read reviews and compare what others experienced with the app support team.

Features

Not all budgeting apps are mobile-friendly; some don’t link accounts automatically; you have to do it manually. Some send notifications, while others don’t. So select the one that best fits your goals.

The Verdict

Budgeting apps help you optimize the spending choices you make every month. They provide insights into your spending habits and let you set a financial goal and make it easy to track cash flow across multiple accounts.

Some budgeting apps like Mint and Debt Free assist you in tracking debt payments easily. Others, like Empower, help you plan for retirement.

While selecting a budgeting app, consider your goals and needs. Also, compare features, customer service, fees, and security. Do more research before making a final decision.

Frequently Asked Questions

What is the best free budgeting app?

The best free budgeting app is free to download, has a user-friendly interface, links to your account, and uses. Right now, Mint is the best choice.

What are the best budgeting apps for 2022?

The best budgeting apps are the ones that help you in planning your finances. Here are the best budgeting apps for 2022: Mint app, YouNeedABudget, Debt Free, Empower, and Digit app.

Are online budgeting apps more effective?

Yes, they apps are more effective than budgeting with paper and a pen. With online budgeting apps, you can create multiple goals accurately and track them easily. Budgeting with paper and a pen may not be easy and accurate to track multiple goals.

Why do people use budgeting apps?

People use them because they are easy and efficient in managing money. Also, it is quick than visiting a bank.