Form 2441 Instructions: What Is It?

IRS Form 2441, Child and Dependent Care Expenses form, is a tax form that enables taxpayers to report and claim tax credits for childcare expenses. You could use this form if you paid someone to care for a dependent while you worked or looked for work.

Keep reading to learn more about IRS Form 2441.

Form 2441 Eligibility

To be eligible for the Child and Dependent Care Tax Credit, you must have paid for the care of a dependent child under 13 or a household member who cannot care for themselves due to physical or mental incapacity.

The care expenses must have been paid to someone outside the household to claim the Child and Dependent Care Tax Credit. Spouse, parent, dependent, or child below 19 yrs can’t pay with the credit.

When filling out Form 2441, the first step is identifying the caregiver(s) who were being paid. If any caregivers worked in your home, you might be responsible for paying nanny taxes for your household employees.

If you file your taxes as a single individual, you must have earned income to claim the credit, which you should report on your Form 1040. For married couples filing jointly, both spouses must have earned income unless one was a full-time student or had a disability. However, married couples filing separately (with some exceptions, such as separated spouses) cannot claim this credit. Check Pub. 501, Deductions, Exemptions, Standards, and Filing information.

How Much is the Child and Dependent Care Worth?

In the past, the credit was limited to $3,000 for one qualifying individual or $6,000 for more than two qualifying individuals, but for the tax year 2021, it increased to $8,000 or $16,000 due to the American Rescue Plan Act.

However, the credit is back to $3,000 or $6,000. That is between 20% and 35% depending on qualified income expenses.

While filling out IRS Form 2441, you must report your earned income, which refers to money earned from employment and self-employment. Earned income may also include taxable disability benefits and tax-free combat pay. You cannot use unearned income like pensions, Social Security benefits, or interest to qualify for the credit.

The Process to Fill Out IRS Form 2441

The earlier version of IRS Form 2441, from 1960, had only one page and ten lines of information. Today’s IRS Form 2441 pdf has three parts and asks for details about your dependents and child care expenses, spanning two pages.

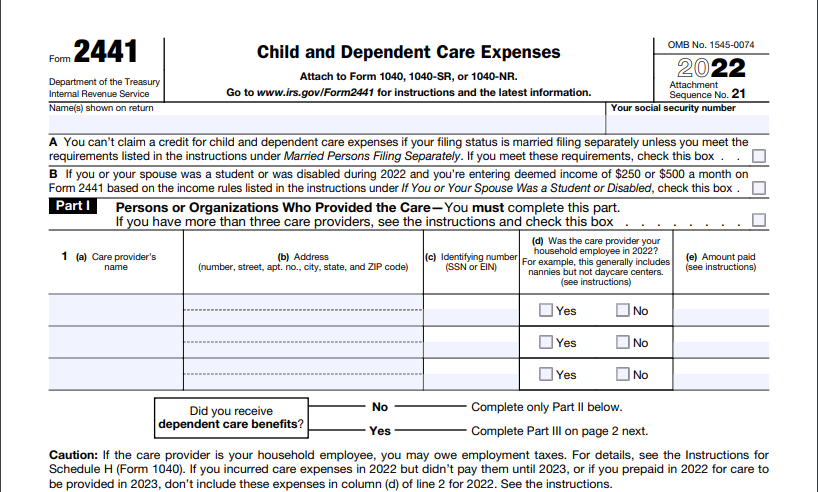

Part I: Persons or Organizations Who Provided the Care

Part I of IRS Form 2441 requires you to furnish details about your care provider, such as their name, address, TIN, and payment amount. You should list the top three care providers on the form but attach additional information for more than three. Remember to provide accurate and complete information to avoid disallowing your credit.

Note that if already received dependent care benefits, you should fill out Part III of the IRS Form 2441; if you have not received dependent care benefits, continue to Part II after filling out Part I of the IRS Form 2441.

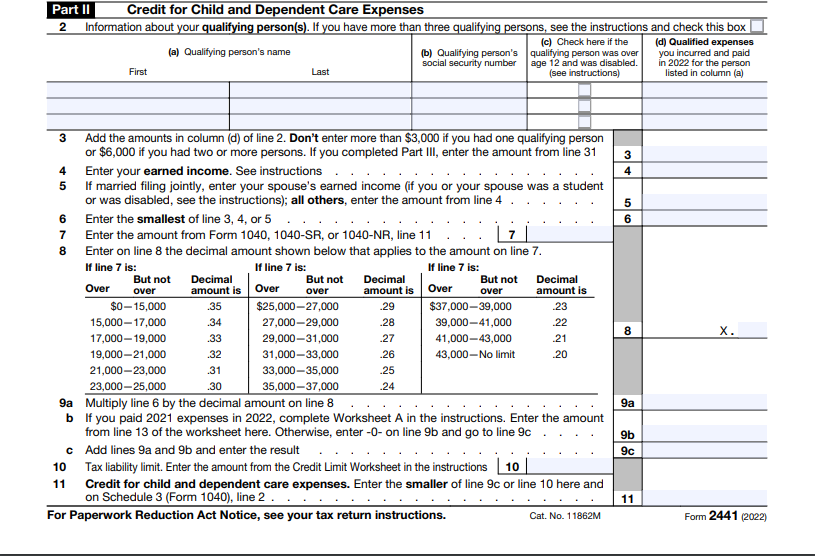

Part II: Credit for Child and Dependent Care Expenses

Part II, is about the credit. In this section, you’ll calculate the tax credit that you qualify to claim. You start by filing name(s), Social Security Number, and qualified expenses for each individual you paid care for. Next, if claiming for more than one person, sum up the amount and enter the total in Line 3. If you head on straight to part III, you’ll enter the sum from Line 31 in part II.

Lines 4 and 5, enter your earned income and spouse’s income respectively if applicable. Line 6, enter the least of either 3, 4, or 5. Line 7, you’ll enter the amount from line 7 of Form 1040, or amount from line 36 of Form 1040NR. Line 8, use a chart to get a decimal amount corresponding to what you entered on Line 7.

On Line 9, enter the amount you get after multiplying Line 6 by decimal from Line 8. Next you’ll reduce your tax credit by percentage depending on your income. Line 10, enter your tax liability limit from the attached worksheet. Line 11, enter the least of either Line 9 or 10.

Also, enter the amount from Line 11 on line 49 of Schedule 3 of Form 1040, or on Line 47 of Form 1040NR.

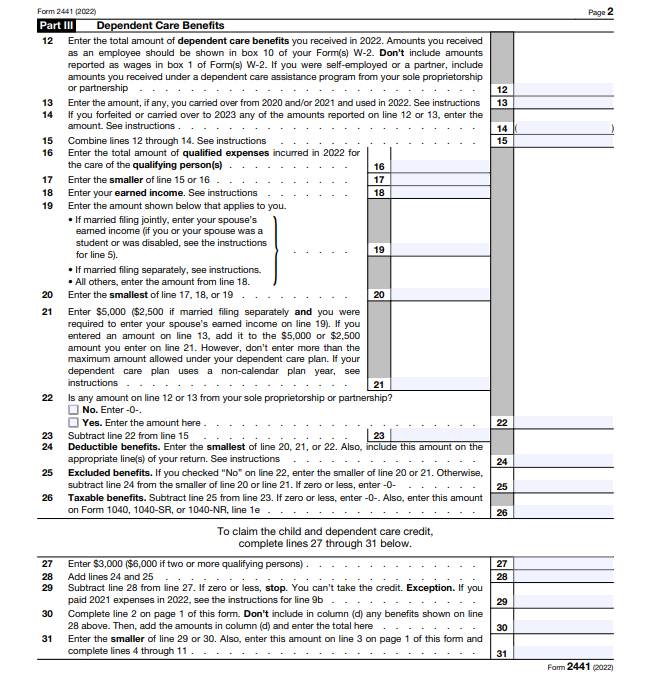

Part III: Dependent Care Benefits

Part III of Form 2441 is where you report any dependent care benefits received for qualifying persons listed in Part II.

If you received dependent benefits, they’ll show in box 10 of the W2 Form that you received from your employer before tax. Key in amount from box 10 of w-2 on Line 12 of Form 2441. On Line 13, enter the amount carried over previous tax years if applicable. Line 15 to 26, adjust the benefits as per instructions on Form 2441. If you received tax free benefits, reduce your eligible credit expenses to avoid double tax.

Lines 27-31 are mandatory for claiming credit in Part II. Enter the amount from Line 31 of part III on Line 3 of part II. To calculate your credit, proceed with the instructions for Lines 4 to 11.

Tips to Calculate Your Taxes Quickly

Here are some tips for calculating your taxes:

- Gather all necessary documents: Before calculating your taxes, make sure you have all the essential documents, such as your W-2 form, 1099 forms, receipts for deductions, and other relevant financial statements.

- Choose the proper filing status: Your filing status can affect your tax liability, so ensure you choose the correct one. There are five filing statuses: Single, Married Filing Jointly, Married Filing Separately, Head of Household, and qualified Widow(er) with Dependent Child.

- Calculate your taxable income: Your taxable income is your total income minus any deductions and exemptions. Use the IRS tax tables or a tax calculator to determine your tax liability.

- Consider tax credits and deductions: Tax credits and deductions can lower your tax liability. Standard deductions include charitable contributions, mortgage interest, and state and local taxes. Common tax credits include the Earned Income Tax Credit, the Child Tax Credit, and the American Opportunity Tax Credit.

- Remember self-employment taxes: If you are self-employed, you must pay self-employment and income taxes. Use Schedule SE to calculate your self-employment tax liability.

- Review your calculations: Double-check your calculations to make sure you have everything correct. The IRS offers a free tool called “Where’s My Refund?” that can help you check the status of your refund.

- File your taxes on time: Ensure you file your taxes on time to avoid penalties and interest charges. If you can’t file your taxes on time, consider filing for an extension.

The Bottom Line

Completing IRS Form 2441 can initially seem daunting, but following the instructions carefully and providing accurate information can save you money through the Child and Dependent Care Tax Credit. It’s important to remember that you can only claim the credit if you meet specific eligibility requirements, including having earned income and paying for qualifying care expenses.

To ensure that you get all the available credits, take the time to read the instructions thoroughly and seek help from a tax professional if needed. Remember to double-check your entries for accuracy before submitting your form. So, if you’re eligible for the credit, claim it and maximize your tax savings.

IRS Form 2441 Instructions FAQs

What are dependent care benefits?

Dependent care benefits can encompass a range of payments made by employers or employees to care for qualifying dependents. It may include direct costs to care providers, the value of employer-sponsored daycare facilities, and pre-tax contributions made through a dependent care FSA.

These benefits may result in a reduction of an employee’s salary. If you received such benefits, you should report them on your Form W-2 (box 10) or Schedule K-1 (box 13 with code O for partners). Properly accounting for dependent care benefits is crucial when filling out IRS Form 2441.

What is reject code f2441 526?

The issue is that the IRS, not eFile.com, has denied your return because someone else has already claimed one of your dependents for the Child Care Tax Credit on a different tax return filed with the IRS, which may also impact your state tax return if applicable.

What is reject code 535?

This error code suggests a discrepancy between a dependent’s social security number and their birth year, which the IRS cross-checks with data from the Social Security Administration.

How do you calculate dependent care?

Depending on your AGI, the Dependent Care Credit varies from 20% to 35% of eligible expenses. For one qualifying individual, the maximum eligible expense is $3,000.

Where do I file Form 2441?

Your tax software will automatically include Form 2441 with your tax return if you file through electronic tax returns. If you file by mail, you’ll attach this form and supporting documents to the IRS centre.

Where can I get Form 2441?

You can get Form 2441 from the IRS website, online, or by mail. Note, it’s your responsibility to ensure you complete and file it with your taxes. Your Child and Dependent Care provider will not send it to you.